| 30-Aug-2013 | BTO | + | 2 | KO | 9 | 20 | $36 | PUT | $0.12 | DEBIT | ($24.00) | |

| 30-Aug-2013 | STO | - | 2 | KO | 9 | 20 | $37 | PUT | $0.29 | CREDIT | $58.00 |

Friday, August 30, 2013

Thursday, August 29, 2013

Initiated Bear Call Spread on $RUT

| 29-Aug-2013 | BTO | + | 2 | RUT | 9 | 5 | $1070 | CALL | $0.25 | DEBIT | ($50.00) | |

| 29-Aug-2013 | STO | - | 2 | RUT | 9 | 5 | $1060 | CALL | $0.70 | CREDIT | $140.00 |

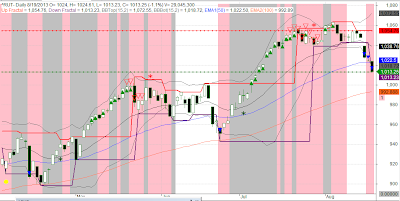

I currently have several Bear Call Spreads on a Bull Put Spread going on in Blue. I think the RUT will stay in this range for awhile.

Wednesday, August 28, 2013

Monday, August 26, 2013

Initiated $RUT Bear Call Spread Strike 1060

| 23-Aug-2013 | BTO | + | 2 | RUT | 9 | 12 | 1070 | CALL | $2.75 | DEBIT | ($550.00) | |

| 23-Aug-2013 | STO | - | 2 | RUT | 9 | 12 | 1060 | CALL | $5.10 | CREDIT | $1,020.00 |

Initiated $CAT Bull Put Spread

| 26-Aug-2013 | BTO | + | 2 | SPX | 9 | 20 | $77.5 | PUT | $0.19 | DEBIT | ($38.00) | |

| 26-Aug-2013 | STO | - | 2 | SPX | 9 | 20 | $80 | PUT | $0.42 | CREDIT | $84.00 |

Sunday, August 25, 2013

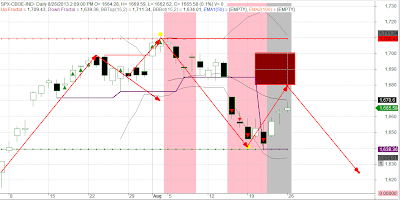

130823 $RUT

This was a 5 DTE trade. Trading around 1013 - 1014. I did not think it would go up to 1050 in five days considering the FED announcements.

| 19-Aug-2013 | BTO | + | 2 | RUT | 8 | 22 | $1060 | CALL | $0.16 | DEBIT | ($32.00) | |

| 19-Aug-2013 | STO | - | 2 | RUT | 8 | 22 | $1050 | CALL | $0.51 | CREDIT | $102.00 |

| 19-Aug-2013 | BTO | + | 2 | RUT | 8 | 22 | $1060 | CALL | $0.16 | DEBIT | ($32.00) | |

| 19-Aug-2013 | STO | - | 2 | RUT | 8 | 22 | $1050 | CALL | $0.51 | CREDIT | $102.00 | |

| 23-Aug-2013 | STC | - | 2 | RUT | 8 | $1060 | CALL | $0.00 | CREDIT | $0.00 | ||

| 23-Aug-2013 | BTC | + | 2 | RUT | 8 | $1050 | CALL | $0.00 | DEBIT | $0.00 |

| $66.21 |

Subscribe to:

Posts (Atom)