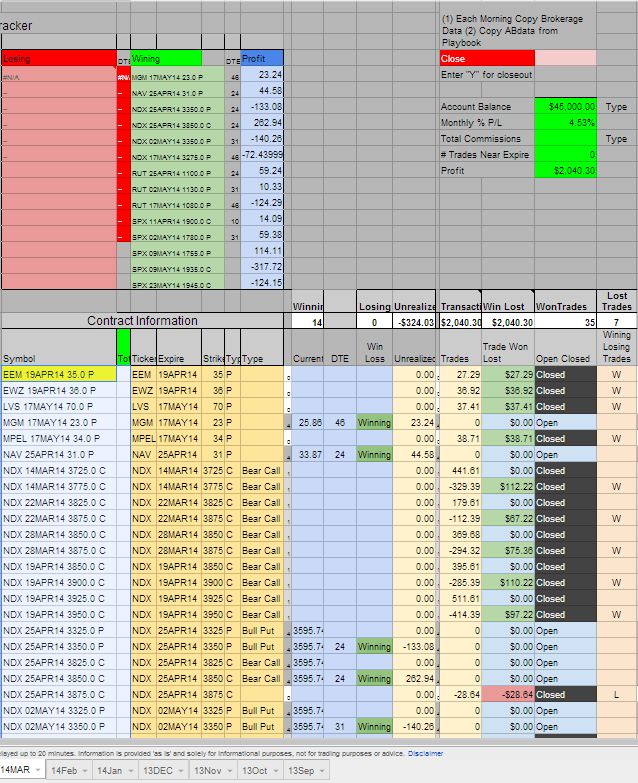

Full Spreadsheet click here.

My current OPen trades are:

| My Trades | |||

| Act | Legs | Spreads | Win Lose |

| + | MGM 17MAY14 23.0 P | Winning | |

| - | NAV 25APR14 31.0 P | Winning | |

| + | NDX 25APR14 3325.0 P | Bull Put | |

| - | NDX 25APR14 3350.0 P | Bull Put | Winning |

| - | NDX 25APR14 3825.0 C | Bear Call | |

| + | NDX 25APR14 3850.0 C | Bear Call | Winning |

| + | NDX 02MAY14 3325.0 P | Bull Put | |

| - | NDX 02MAY14 3350.0 P | Bull Put | Winning |

| + | NDX 17MAY14 3250.0 P | Bull Put | |

| - | NDX 17MAY14 3275.0 P | Bull Put | Winning |

| + | RUT 25APR14 1090.0 P | Bull Put | |

| - | RUT 25APR14 1100.0 P | Bull Put | Winning |

| + | RUT 02MAY14 1120.0 P | Bull Put | |

| - | RUT 02MAY14 1130.0 P | Bull Put | Winning |

| + | RUT 17MAY14 1070.0 P | Bull Put | |

| - | RUT 17MAY14 1080.0 P | Bull Put | Winning |

| - | SPX 11APR14 1890.0 C | Bear Call | |

| + | SPX 11APR14 1900.0 C | Bear Call | Winning |

| + | SPX 02MAY14 1770.0 P | Bull Put | |

| - | SPX 02MAY14 1780.0 P | Bull Put | Winning |

| - | SPX 02MAY14 1920.0 C | Bear Call | |

| - | SPX 09MAY14 1745.0 P | Bull Put | |

| + | SPX 09MAY14 1755.0 P | Bull Put | Winning |

| + | SPX 09MAY14 1925.0 C | Bear Call | |

| - | SPX 09MAY14 1935.0 C | Bear Call | Winning |

| - | SPX 17MAY14 1960.0 C | ||

| + | SPX 23MAY14 1940.0 C | ||

| + | SPX 23MAY14 1945.0 C | Bear Call | Winning |

| -- | -- | -- | |

No comments:

Post a Comment